OUR SPECIALIZATION

WHY WE?

Core Business lies in the basis of the holding activity – a new concept of business development that enable to create individual approaches for each of the situations in the sphere of financial and legal issues, becoming the key to getting the results and growth of cash flows of the Client.

OUR MAIN ADVANTAGES:

RESPONSIBILITY

We are ready to take care of all issues and responsible for the fiscal and financial sphere.

CONCENTRATION

Serving our Clients, we give them opportunity to do the primary – Core Business and not waste time on non-core activities.

MANAGEMENT

Company that invests and develops its strong side – manages the competitive environment and offers the most effective strategy, which helps to capture market advantage.

CONSERVATIVE AND STANDARDIZED APPROACH

Work based on international practices, agreements with financial consultancy coalition. All performed according to standard schemes, no creativity for not to bear the risk and responsibility.

SIMPLIFIED AND AGGRESSIVE METHODS OF TAX PLANNING

Workarounds, shadow markets, the use of new untested schemes and huge risks, as well for Client so for the Contractor.

UNIVERSUM

The ability to combine creativity in dealing with legal methods. The willingness to take responsibility for the decisions and ways to implement them.

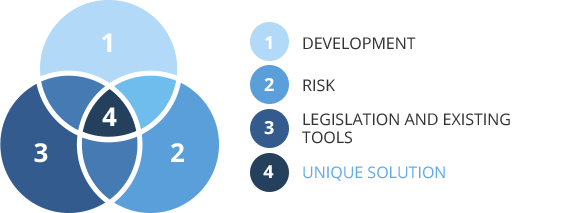

CONCLUSIONS:

WE CREATE UNIQUE SOLUTION FOR OUR CLIENTS, CHOOSING WHICH WE ARE GUIDED BY DEVELOPED SPECIFICALLY UNDER THE CLIENT:

- STRATEGY OF THE COMPANY DEVELOPMENT;

- THE OWNER’S ATTITUDE TO RISKS;

- CURRENT LEGISLATION AND EXISTING TOOLS OF TAX OPTIMIZATION AND PLANNING.

PROJECTS IN THE TAX FIELD

PROJECT MANAGEMENT AND TAX CONSULTING:

Projects in the field of taxation:

- Tax Planning & Compliance (risk assessment in tax planning)

- Advising in structuring transactions to reduce tax costs

PROJECTS IN THE LEGAL FIELD

LEGAL SERVICES:

Controlled and conflict bankruptcy

Unique experience of specific situations, transactions and protection against complex risks

Debtor protection and debt collection